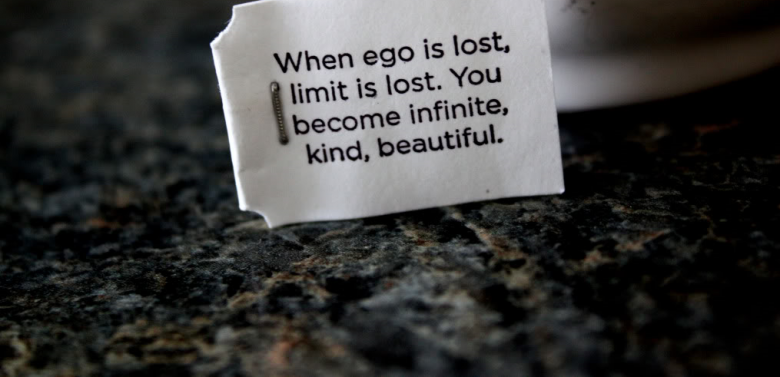

Check Your Ego at the Door and Live Within Your Means

Personal finances are always a big hurdle for a growing family. Understanding what you want and what you actually need can make the difference between the stress of paying off debt and sleeping easy at night. Don’t let your ego drive decisions that could make you miserable in the long run.

Housing – Dont Over Do It

Whether renting or purchasing, don’t get more than what you actually need. Your housing expenses will be the largest monthly expense you encounter. Do not purchase more house than what you actually need.

An affordable payment each month means you aren’t stressed about how to collect the money for your next payment. Instead of eating a weekly family diet of ramen noodles and Banquet microwave meals, you can provide your family with healthy and quality meals. The occasional dinner with your wife is not greeted with terror when you pick up the check.

Housing caused our last financial crisis. People were overextended in a property they could barely afford. Don’t let your ego get in the way. Buy what you can afford and live comfortably.

Modern Transportation

Everyone loves that new car smell. My neighbor has 2004 Ford pickup truck and somehow it still has the Ford factory smell. Your vehicle payment is another big chunk of your monthly income. Be smart when chooing to purchase a vehicle.

Before looking to make a new car purchase, be sure to evaluate your current vehicle. Is it reliable and efficient transportation? If the answer is “yes”, then you’re in no rush to add more debt to your family budget. An average payment will be between $300-$450.

For me, the magic number is 10 years. I expect my vehicles to last for over 10 years before I’m going to look in to a new one. Save up and pay in cash, or make a larger down payment. Extend out the terms, but make larger monthly payments in order to pay it off as soon as possible.

Childcare and School

For an infant/toddler, monthly daycare can be as much as a mortgage payment. When our first child got out of daycare and started in public school, my wife and I thought we were rich. The extra income was great. Then we had our second child and there went the extra income.

My wife and I both made the decision to work instead of staying home with the babies. It’s a decision we have never regretted. Daycare has helped develop our kids social skills and immune systems.

We have also made the decision for our kids to go to public school. Knowing they would be in public school had a big impact on where we lived. Our first child is in schools that were just built in the past 5 years. Had we chosen to live somewhere else, private school may have been an option and we would have needed to work that into our monthly budget. If that is not an option financially, look in to relocating to the best public school district you can find.

Don’t Let Your Ego Make Your Decisions

All three of the previous examples could have been ego driven. We can afford more. Instead of a three bedroom, two bath house, we could have afforded an extra 1500 square feet with an extra bedroom and bath. We didn’t need it. Now we’re looking for a weekend place on the lake because we can afford it.

We could lease a new Lexus or BMW every three years and look rich and cool. Put our kids in private school and let everyone know how much smarter and classier our kids are than theirs. We don’t need to or want to. Not only would we add pressure to our lives to keep up with the trends, but we would be sending the same message to our kids. They don’t need the pressure of having to have it all effecting decisions they make as the grow into and become adults.

I’m a competitve guy, but I don’t need grand material items to know my worth. My worth is being a good father, husband and community member. This is what I hope to pass on to my kids. Abundance is a mindset, not an item.

Please share this post with others if it has been beneficial and post feedback in the comments section.

Leave a Comment